tax lien search colorado

Search Information On Liens Possible Owners Location Estimated Value Comps More. A tax lien is a claim against a property imposed by law to secure the payment of taxes.

Search Information On Liens Possible Owners Location Estimated Value Comps More.

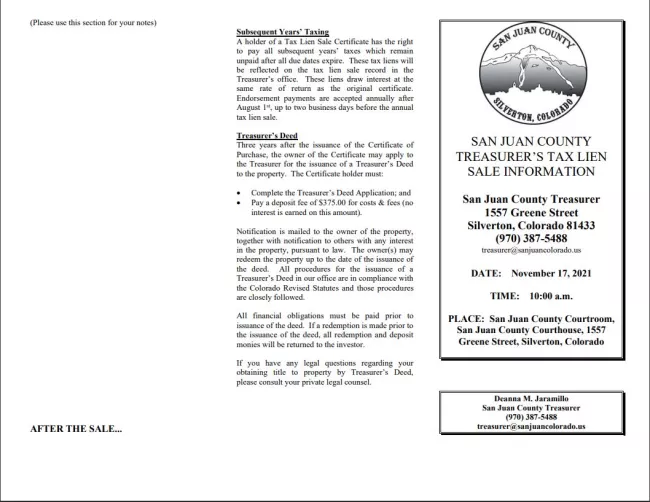

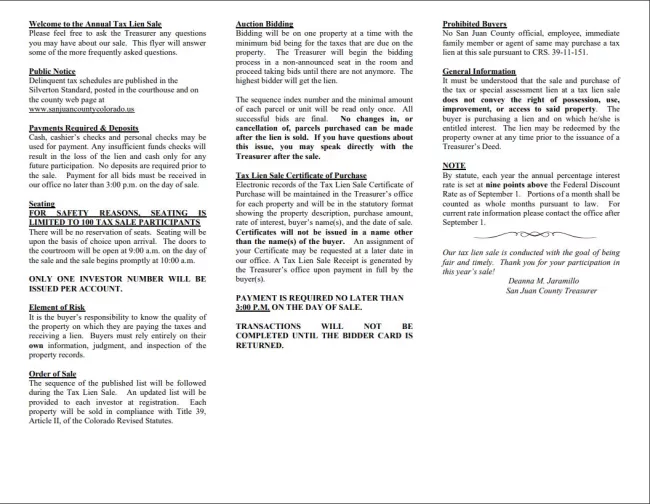

. Colorado Secretary of State. Tax Lien Sale Newsletter 2 - November 2021. The tax lien may be redeemed up until 959 am.

A fee of 220 per searchhistory payable to the Colorado Department of Revenue must be submitted. In Colorado government agencies that manage lien records like the county clerks office provide free lien searches to interested persons. The interest rate paid to the investor is established by state statute and is based on the federal interest rate at the federal bank of Kansas City on September 1st.

Tax Lien Sale Newsletter 3 - November 2021. Emails marked private however may be subject to public. Each property will be sold in compliance with Title 39 Article II of the.

Free Lien Search in Colorado. You must be present to participate. If the deposit is more than the actual costs a refund check will be forwarded to the tax sale buyer along with the deed.

Ad Ownerly Helps Homeowners Find Data On An Address Lien Owner Info More. Delinquent Real Property Taxes will be advertised once a week for 3 consecutive weeks prior to. For certified records an additional 50 per title record or title history request must.

In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed more. A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid. The next Tax Lien Sale is scheduled for November 16 2022.

Public record property information and parcel maps are available on the Assessors Real Property Search Page. Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership. Search San Miguel recorded documents including property records death records marriage records and tax liens by name document type or date range.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. A tax lien is a lien or a legal interest on a given tax parcel issued by a taxing entity. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

You can pay a title company to do a property search for you but liens are publicly-available information. On the morning of the. Colorado currently has 48042 tax liens available as of June 19.

If the property owner does not pay the property taxes by late. If you have additional questions you may contact our office at 719 520-7900. The federal discount rate is set by the federal government.

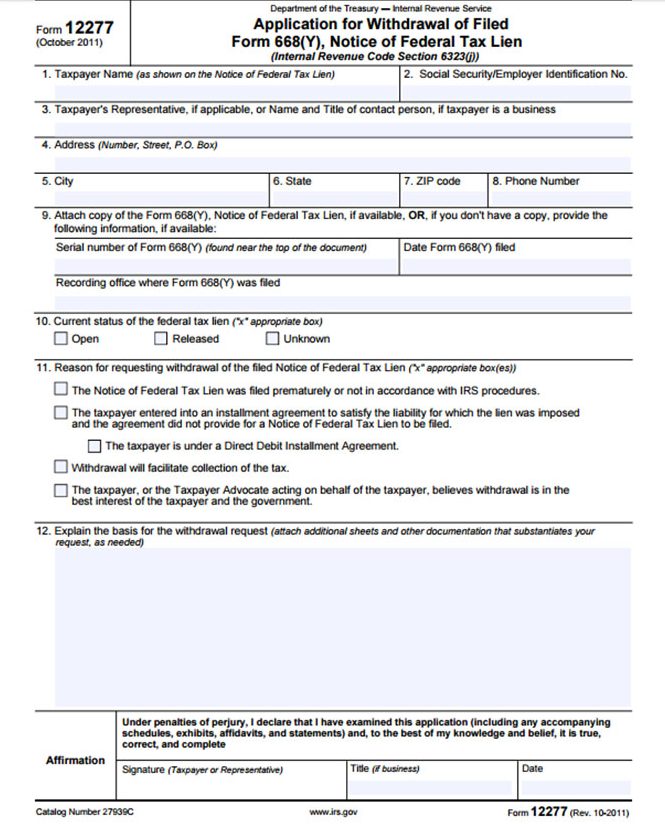

Acquire Valuable Properties Or Get 18-36 Interest. The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS. Ad Ownerly Helps Homeowners Find Data On An Address Lien Owner Info More.

This means the interest rate can change from year to year. And state revenue agencies can place tax liens on parcels but the county treasurers office the. If the property owner does not redeem the property during the three year redemption period the buyer may apply for a deed to the property by presenting the tax lien.

So first check the website for your. Ad Find Information On Any Colorado County Property. How to Find Tax Liens on a Property.

If you received correspondence from our office notifying you that a Treasurers Deed has been applied for please contact our office 970 453-3440. Any unpaid taxes will be advertised for sale in the local newspaper and will be sold if they are still not paid by the day before tax lien public auction. Requestors may visit any.

Ad Find Tax Lien Property Under Market Value in Colorado. When redeemed the Tax Lien Certificate of Purchase will pay nine points over the Federal Reserve Discount Rate as of September 1st on the year of the tax sale CRS 39-12-103. The amount sold at the tax.

There are currently 40699 tax lien-related investment opportunities in Colorado including tax lien foreclosure properties that are either available for sale or worth pursuing. Clerk and Recorder of Deeds San. Colorado has a rate of return at 9 above the federal discount rate.

The real estate tax lien public auction of. CDOR will send a Notice of Intent to Issue. Search Public Property Records In Colorado County By Address.

Open in New Tab Close Window.

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And Investing Tutorial Investing Ebook Series

Pin On Real Estate Is My Passion

Over The Counter Tax Liens Get A Free Course Value 197

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Free Federal Tax Lien Search Searchquarry Com

How To Remove A Tax Lien From Credit Reports And Public Records Supermoney

Make Money With Tax Liens Know The Rules Ted Thomas

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

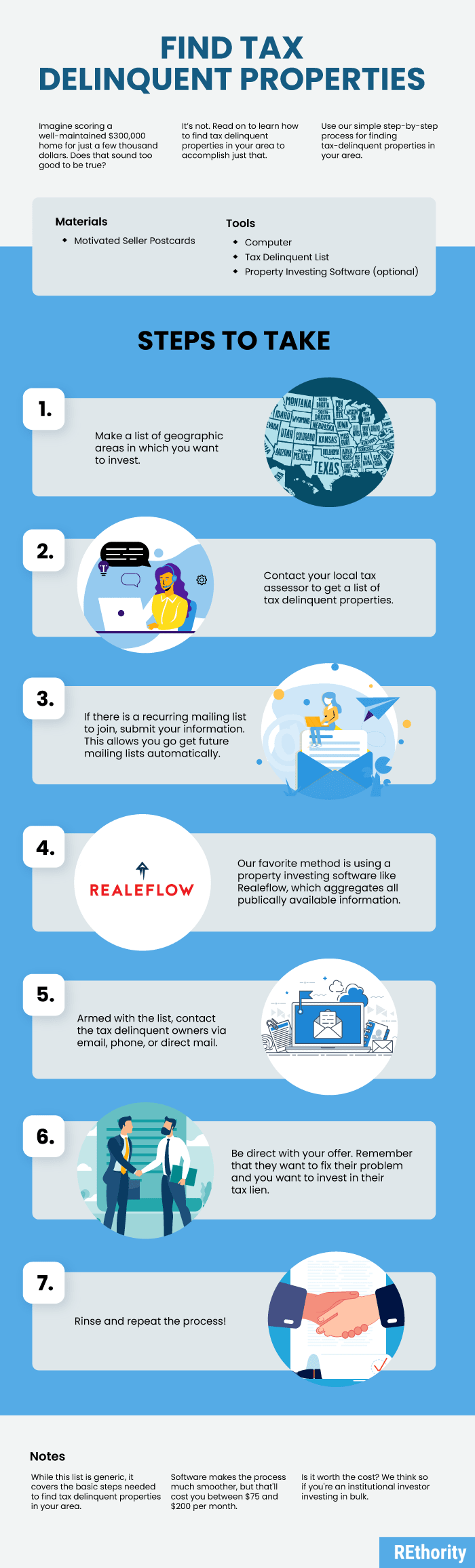

How To Find Tax Delinquent Properties In Your Area Rethority

The Essential List Of Tax Lien Certificate States

Tax Attorney Irs Tax Attorney Tax Lawyer Lifeback Tax

Irs Puts 1 4 Billion Liens On Brockman S Aspen Properties Aspentimes Com

Fake Tax Warrarnts Warning Fake Tax Lien Warrants Received In Larimer County